illinois payroll withholding calculator

2022 Federal Tax Withholding Calculator 2022 Federal Tax Withholding Calculator. Enter your new tax withholding.

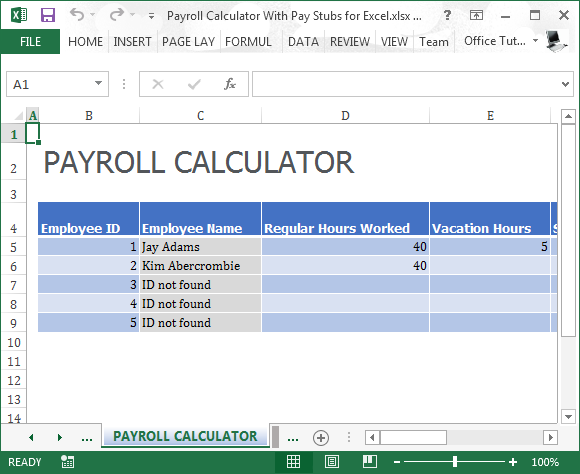

Payroll Calculator Free Employee Payroll Template For Excel

Just enter the wages tax withholdings and other information required.

. Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The illinois paycheck calculator is designed to help you understand your financial situation and determine what you owe in taxes. Get Started With ADP Payroll.

Illinois State Disbursement Unit. Or keep the same amount. Ad See how tax withholding solutions from Sovos improve accuracy and efficiency.

The calculator on this page is provided through the adp. This is a projection based on information you provide. SERS Contact Information 2101 S.

Ad Compare This Years Top 5 Free Payroll Software. Discover ADP Payroll Benefits Insurance Time Talent HR More. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

Ad Process Payroll Faster Easier With ADP Payroll. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Take A Guided Tour Today. Free Federal and Illinois Paycheck Withholding Calculator. Carol Stream IL 60197-5400.

Ad Payroll So Easy You Can Set It Up Run It Yourself. All Services Backed by Tax Guarantee. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

This free easy to use payroll calculator will calculate your take home pay. To change your tax withholding amount. Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use.

The Best HR Payroll Partner For Medium and Small Businesses. Illinois Hourly Paycheck Calculator Results. Illinois Withholding Tax Tables Illinois Income Tax withholding at 495 percent 0495 Based on allowances claimed on Form IL-W-4 Illinois Withholding Allowance Certificate Daily Payroll.

Download or Email IL IL-W-4 More Fillable Forms Register and Subscribe Now. This is a projection based on information you. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Ad Process Payroll Faster Easier With ADP Payroll. This is a projection based on information. Tax withheld 0495 x wages line 1 allowances x 2375 line 2 allowances x 1000 number of pay periods.

If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. Get Started With ADP Payroll. The results are broken up into three sections.

2022 Federal Tax Withholding Calculator. Instead you fill out Steps 2 3 and 4. Below are your Illinois salary paycheck results.

2022 Federal Tax Withholding Calculator. If the income is paid biweekly multiply the minimum wage times 60 60 x 825 495. Free Unbiased Reviews Top Picks.

This calculator is a tool to estimate how much federal income tax will be withheld. Illinois child support payment information. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4.

Illinois Hourly Paycheck Calculator. Deducts the child support withholding from the employees wages. Your employer will withhold money from each of.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. Use your estimate to change your tax withholding amount on Form W-4. Paycheck Results is your gross pay and specific.

Improve the accuracy and efficiency of payroll non-wage and unemployment tax management. Supports hourly salary income and multiple pay frequencies. Discover ADP Payroll Benefits Insurance Time Talent HR More.

This is a projection based on information you provide. Ad See Why 40000 Organizations Trust Paycor. Remit Withholding for Child Support to.

Payroll Calculator With Pay Stubs For Excel

Payroll Tax Calculator Store 60 Off Ilikepinga Com

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Tax Calculator For Employers Gusto

Commercialista Milano Tax Accountant Accounting Money Savvy

Paycheck Calculator Take Home Pay Calculator

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Tax Calculator Store 60 Off Ilikepinga Com

How To Calculate Payroll Taxes Methods Examples More

Illinois Paycheck Calculator Adp

Illinois Paycheck Calculator Smartasset

Payroll Calculator Free Employee Payroll Template For Excel

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Paycheck Calculator Take Home Pay Calculator

Payroll Tax Calculator Store 60 Off Ilikepinga Com

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free Online Paycheck Calculator Calculate Take Home Pay 2022